What are best Index Funds in India? Index Funds in India is a passive investing which meets diversified growth for a secure financial future.

Index fund have become an increasingly popular way for Indian investors to participate in the stock market. This detailed guide will explain what index funds are, their benefits for Indian investors, how to invest in index funds in India, strategies for optimal returns, and some top index funds available in the Indian market.

What Are Best Index Funds in India?

An index fund is a type of mutual fund that aims to replicate the performance of a market index, like the NIFTY 50 or S&P BSE SENSEX. Index funds invest in the same stocks that make up the index, in the same proportions.

For example, an NIFTY 50 index fund will invest in the 50 large-cap stocks that comprise the index. As the value of the underlying stocks changes, so does the index fund’s net asset value (NAV). Index funds follow a passive investment strategy instead of active stock picking.

| Top 10 Digital Marketing Source | Top 10 Niches to Make Money Online |

| Tax Saving Investment Schemes | Top 10 Passive Income Ideas |

Some key features of index funds

- Invest in stocks matching a market index

- Seek to replicate index performance

- Managed passively, not actively

- Lower expenses than active mutual funds

- Diversification across many securities

- Simpler, long-term investment approach

In short, index funds offer Indian investors an easy and low-cost way to invest in the overall stock market by matching index performance.

Growth of Index Funds in India

Benefits of Index Funds for Indian Investors

Index funds have several attractive benefits that make them well-suited for Indian investors compared to actively managed mutual funds:

Lower Expense Ratios

Index funds have lower expense ratios as they do not require high management fees for fund managers and stock analysts. This results in higher returns.

Transparency

Index funds disclose their portfolio holdings daily tracking a published index. Actively managed funds can have hidden risks.

Diversification

Index funds hold a wide array of stocks covering all sectors and market caps. This reduces portfolio volatility and company-specific risks.

Market-Like Returns

Index funds generate market-level returns before fees instead of trying to beat the market. This provides consistent performance.

Tax Efficiency

The passive buy-and-hold strategy of index funds results in lower portfolio turnover and capital gains distributions leading to higher post-tax returns.

Better Performance

Index funds have historically outperformed the majority of active large-cap mutual funds in India over long terms.

How to Invest in Index Funds in India

Investing in index funds in India is straightforward for both new and seasoned investors:

Open a Demat Account

Open a demat and trading account with banks or brokers. This provides access to invest in index funds and ETFs. Best App to open demat account for Index funds investment is Groww. To open account please click here.

Determine Asset Allocation

Decide your split between equity and debt based on risk appetite and investment goals. Start with higher equity allocation when young.

Select Index Funds

Pick 1-2 index funds tracking benchmarks like NIFTY 50, SENSEX, NIFTY Next 50 etc. aligned with your asset allocation.

Invest Lump Sum or SIP

Invest a lump sum or via systematic investment plan (SIP) in selected index funds. SIPs allow periodic investments.

Hold Long Term

Hold index funds for long term instead of timing the market. Ignore short-term volatility and benefit from compounding.

Choosing the Best Index Funds in India

Here are key factors to evaluate when selecting index funds in India:

Index Tracked – Ensure the index has strong market representation like NIFTY 50, SENSEX.

Fund Size – Prefer larger funds with assets over ₹500 crores for better tracking and liquidity.

Expense Ratio– Lower is better. Opt for expense ratio below 0.5%.

Tracking Error– Tracking error versus index should be minimal, within 2% is decent.

Fund House– Go with reputed AMCs like UTI, SBI, ICICI, HDFC for index funds.

Liquidity – Larger funds see good volumes for exit flexibility. Check historical turnover.

Performance History- Funds with 10+ year history are ideal. Review returns versus index.

Investment Strategies for Index Funds in India

Here are some proven strategies Indian investors can apply for optimal index fund returns:

Asset Allocation: Define your equity-debt mix based on goals, time horizon instead of market timing. Rebalance occasionally.

SIP Investing: Invest equal amounts monthly or quarterly via SIPs to benefit from rupee-cost averaging and compounding.

Reinvest Dividends: Opt to reinvest dividends from index funds to allow faster growth through the power of compounding.

Stay Invested for Long Term: Resist the urge to time markets. Remain invested through ups and downs to benefit from India’s equity growth.

Focus on Total Costs: Keep overall costs low by choosing index funds with low expense ratios and minimizing portfolio churn.

Tax Planning: Use index funds in ELSS funds for tax savings under Section 80C. Hold in equity MFs over 1 year for long term capital gains tax.

Top Index Funds in India

Here are some of the best index funds in India across market capitalizations to consider:

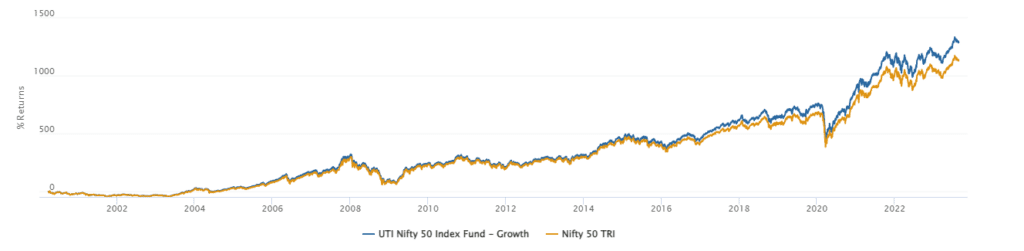

UTI Nifty Index Fund

Tracks NIFTY 50. Low 0.1% expense ratio. ₹12,000 crore assets under management (AUM).

HDFC Index Fund Sensex Plan

Tracks BSE SENSEX 30 with assets of ₹3,000 crores. Expense ratio of 0.1%.

Motilal Oswal Nifty 500 Index Fund

Passively managed fund mirroring Nifty 500 Index. Competitive 0.15% expense ratio.

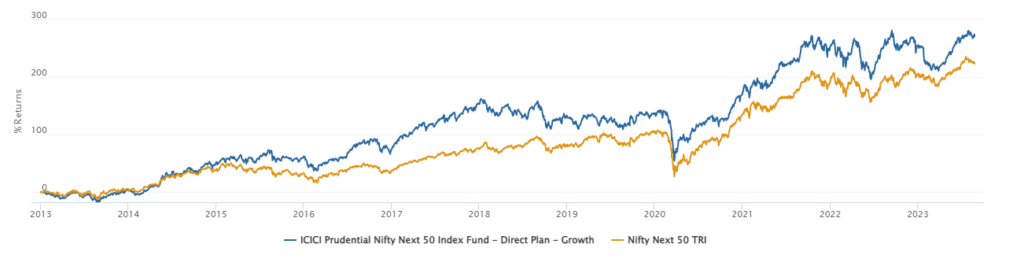

ICICI Prudential Nifty Next 50 Index Fund

Tracks Nifty Next 50 stocks. Managed by largest AMC in India by AUM.

SBI Nifty Index Fund

Among the cheapest index funds with expense ratio of just 0.07%. AUM over ₹2,450 crore.

Aditya Birla Sun Life Index Fund

Covers NIFTY 50 with low 0.22% expense ratio. Run by reputed AMC.

Conclusion

I hope this detailed guide has provided Indian investors a good understanding of index fund investing. The key takeaways are that index funds offer diversification, market-level returns, transparency, and tax efficiency at low costs.

For long-term passive investing suited to Indian markets, index funds can be an ideal choice compared to actively managed mutual funds. Leading fund houses offer index funds tracking benchmarks like NIFTY 50 or BSE SENSEX providing an easy way to invest in India’s economic growth.