Explore Adani Wilmar’s share price in July 2023 with a comprehensive analysis. Stay updated on the stock’s performance and trends.

Presenting an in-depth analysis of Adani Wilmar share price, a trailblazing FMCG company at the forefront of the industry. Adani Wilmar, a leading FMCG company in India, with a strong portfolio of brands in edible oils, packaged foods, and consumer staples, has been closely watched for its share price movements. Adani Wilmar share price has been on a volatile ride in recent months, but it has been trending upwards in recent weeks.

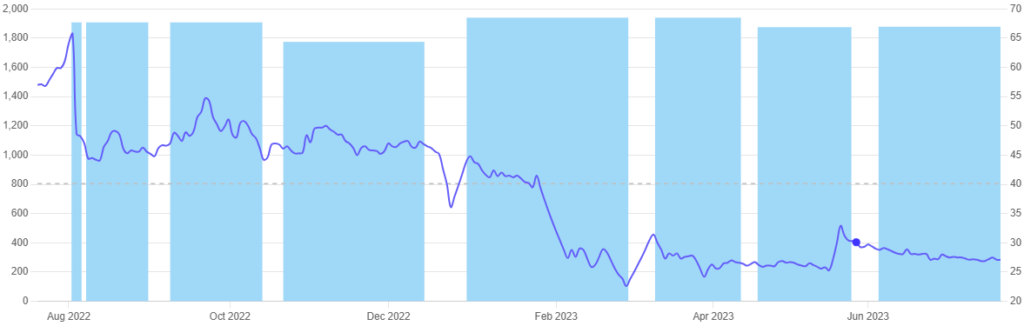

As of July 20, 2023, Adani Wilmar’s share price is trading at Rs. 402.00. The stock has a market capitalization of Rs. 2.5 trillion and a 52-week high of Rs. 841.70.

Technical Analysis of Adani Wilmar share price

In terms of technical analysis, the stock price performance and market indicators are evaluated to assess the potential future price movements. Based on the available data:

- Adani Wilmar share price fell 35.5% and underperformed its sector by 47.9% in the past year. From a technical standpoint, the stock price experienced a significant decline of 35.5% over the past year, indicating poor performance compared to the sector, which underperformed by 47.9%.

- Adani Wilmar share price is just 23% shy of 52 week low (Rs. 327.25)

- Adani Wilmar share is trading below the weekly 20 EMA.

- The monthly support zone is from Rs 363 to 385.

Fundamental Analysis of Adani Wilmar share Price

Fundamental analysis involves assessing the company’s financial health, profitability, and industry trends.

- Adani Wilmar share price experienced a positive 7.5% annual revenue growth in the last year, reaching Rs 58,446.2 Crores. However, it fell slightly behind the sector’s average revenue growth of 12.4% for the same fiscal year.

- During the quarter, the company faced a 7.3% YoY decline in revenue, amounting to Rs 13,945 Crores, while the sector’s average revenue growth YoY for the quarter was 7%.

- On the profitability front, Adani Wilmar encountered a challenge with a significant 27.6% decrease in annual net profit, resulting in Rs 582.1 Crores. In comparison, the sector’s average net profit growth for the same fiscal year was 11.5%. Nevertheless, the company’s net profit decline of 27.6% was lower than the sector’s average growth, indicating a relatively more resilient performance.

- Quarterly net profit exhibited a substantial decline of 60% YoY, amounting to Rs 93.6 Crores, while the sector’s average net profit growth YoY for the quarter was 27.8%.

- The company’s Price to Earnings Ratio stands at 89.9, surpassing the sector’s PE ratio of 65.7. This suggests positive market sentiment and higher growth expectations for Adani Wilmar.

- Adani Wilmar share debt-to-equity ratio is 0.3, indicating a healthy financial position, as it remains below 1.

- However, there is room for improvement in the company’s Return on Equity (ROE), which stood at 7.1% for the last financial year, falling short of the desired benchmark of 10%. This implies that the company could enhance its efficiency in utilizing shareholder capital to generate profit.

- In terms of shareholding stability, mutual fund holding in Adani Wilmar changed from 0.02% to 0.06% during the last quarter, while promoter shareholding maintained a steady 87.9%, reflecting confidence in the company’s prospects.

- Furthermore, Adani Wilmar’s Interest Coverage Ratio is a reassuring 2.5, indicating that it comfortably meets its interest payments with its earnings (EBIT). This ratio surpasses the industry benchmark of 1.5, suggesting that the company has sufficient earnings to comfortably cover interest payments.

By considering both technical and fundamental analysis, it is evident that the Adani Wilmar share has experienced negative performance in terms of revenue, net profit, and stock price. However, there are positive aspects such as a higher price-to-earnings ratio, stable promoter shareholding, and satisfactory interest coverage ratio. The company’s return on equity indicates room for improvement.

Know about Adani Wilmar

Adani Wilmar Limited is an Indian multinational FMCG company. It is a joint venture between Adani Group and Wilmar International. The company was founded in 1999 and is headquartered in Ahmedabad, Gujarat.

Adani Wilmar is one of the largest edible oil companies in India. It has a market share of over 25% in the edible oil market in India. The company also manufactures and sells a wide range of other food products, including wheat flour, rice, pulses, sugar, and branded packaged foods.

Adani Wilmar’s products are sold under a variety of brands, including Fortune, Sundrop, and Alife. The company’s products are available in over 200,000 retail outlets in India.

Adani Wilmar is also a leading player in the oleochemicals industry. The company manufactures a wide range of oleochemical products, including fatty acids, glycerine, and soaps. Adani Wilmar’s oleochemical products are used in a variety of industries, including the food industry, the personal care industry, and the industrial sector.

In addition to its edible oil and oleochemical businesses, Adani Wilmar also has interests in the renewable energy sector. The company is a leading developer of solar power projects in India. Adani Wilmar’s solar power projects have a total capacity of over 1 GW.

Adani Wilmar is a publicly listed company. It is listed on the Bombay Stock Exchange and the National Stock Exchange of India. The company’s shares are traded under the symbol AWL.

Conclusion

Based on the technical and fundamental analysis, Adani Wilmar’s share price is currently trading at a reasonable valuation. The stock has the potential to rise in the near future, but it is important to monitor the technical indicators and the broader market conditions before making any investment decisions.

Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Please do your own research before making any investment decisions.

FAQs: Adani Wilmar Share Price

1. What is the current Adani Wilmar share price?

As of July 20, 2023, the current share price of Adani Wilmar is Rs. 402.30.

2. What are the 52-week high and low of Adani Wilmar share price?

The 52-week high of Adani Wilmar share price is Rs. 841.90, and the 52-week low is Rs. 327.

3. What is the market capitalization of Adani Wilmar?

The market capitalization of Adani Wilmar is Rs. 2.8 trillion.

4. What are the major products of Adani Wilmar?

Adani Wilmar is a leading FMCG company in India offering a wide range of products. Some of its major products include Fortune oil, King’s salt, Avsar pulses, and Jubilee sugar.

5. What is the future outlook for Adani Wilmar?

Adani Wilmar is well-established with a strong track record and poised to benefit from the growing demand for FMCG products in India. The company is expanding its product portfolio and entering new markets, resulting in a positive future outlook.

6. Is Adani Wilmar a good buy for investment?

Whether Adani Wilmar is a good investment depends on your investment goals and risk appetite. It offers exposure to the booming FMCG market in India but carries inherent risks due to commodity price volatility and macro-economic factors. It’s essential to conduct thorough research and seek professional advice before making any investment decisions.

7. How does Adani Wilmar’s share price perform in the market?

Adani Wilmar’s share price has experienced fluctuations in the past 52 weeks, reaching a high of Rs. 841.90 and a low of Rs. 327. Its current share price as of July 20, 2023, is Rs. 402.30. The market capitalization of Rs. 2.8 trillion reflects the company’s significant presence in the FMCG sector.

8. What factors contribute to Adani Wilmar’s positive future outlook?

Adani Wilmar’s positive future outlook stems from its strong track record, strategic positioning, and growth prospects in the FMCG market. The company’s expansion into new markets and a diverse product range add to its potential for sustained growth.

9. How does Adani Wilmar compare to other FMCG companies in India?

Adani Wilmar stands out as a leading FMCG company in India, boasting a broad product portfolio and a substantial market capitalization. Its future prospects and expansion plans differentiate it from other competitors in the sector.

10. Are there any risks associated with investing in Adani Wilmar?

Yes, investing in Adani Wilmar comes with inherent risks, including commodity price volatility and macro-economic factors that can impact the company’s performance and share price. Potential investors should carefully assess their risk tolerance before considering an investment.

To know more about such financial blog please visit here.